Financial Literacy

Financial literacy is the possession of skills that allows people to make smart decisions with their money. We focus on raising awareness about the importance of planning for a secure financial future. Financial literacy is a lifelong lesson, start today with our 30 days of financial tips through these various resources.

Please Note: The links below are Third Party Sites. You will be asked to accept the following Disclaimer prior to being directed to the page. By accessing the noted link you will be leaving Crest Savings Bank’s website and entering a website hosted by another party. Crest Savings Bank has not approved this as a reliable partner site. Please be advised that you will no longer be subject to, or under the protection of, the privacy and security policies of Crest Savings Bank’s website. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of Crest Savings Bank.

Welcome

Let’s begin your journey with financial well-being assessment. The Consumer Financial Protection Board created a 10-question tool. It will show how you measure up against other Americans helping you set a direction for your financial future.

Week 1 – Manage Your Finances

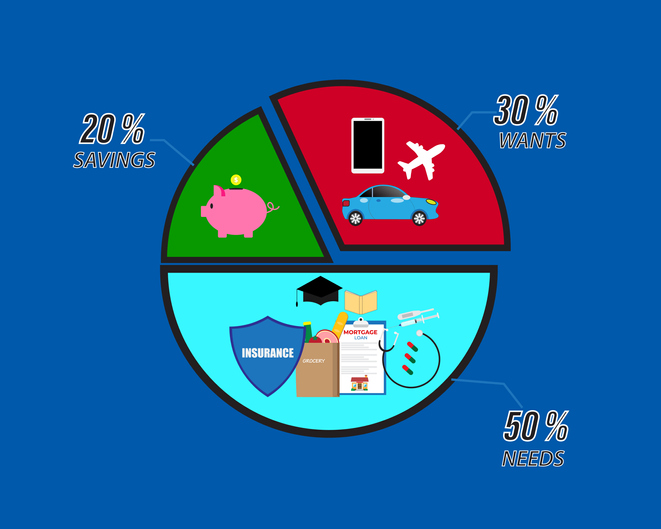

Making the most of your money starts with five building blocks for managing and growing your money — The MyMoney Five. MyMoney.gov suggest you keep these five principles in mind as you make day-to-day decisions and plan your financial goals.

THE FIVE PRINCIPLES

- EARN – Make the most of what you earn by understanding your pay and benefits.

- SAVE & INVEST – It’s never too early to start saving for future goals such as a house or retirement, even by saving small amounts.

- PROTECT – Taking precautions about your financial situation, accumulate emergency savings, and have the right insurance.

- SPEND – Be sure you are getting a good value, especially with big purchases. Shopping around and comparing prices and products is a good start.

- BORROW – Borrowing money can enable some essential purchases and builds credit, but interest costs can be expensive.

The key to a good budget is including as much information as possible so you can adequately prepare and plan. It’s important to keep accurate records of your spending. This helps you see where you can save money and how much you can reasonably spend. Utilize the FTC Consumer.gov worksheet to start your budget today.

Debt from student loans, mortgages, and credit cards is pretty common. Most families carry about $10,000 in credit card debt. Establish a budget to pay down debts while you save. Avoid spending more money than you bring in, as that leads to financial stress. Points to consider when cutting debt:

- Pay more than the minimum due and pay on time.

- Pay off debts with higher interest rates first.

- Transfer high-rate debts to credit cards with a lower interest rate.

- Use loans for purchases that will appreciate in value like a home.

Here are a few tips to help you get started.

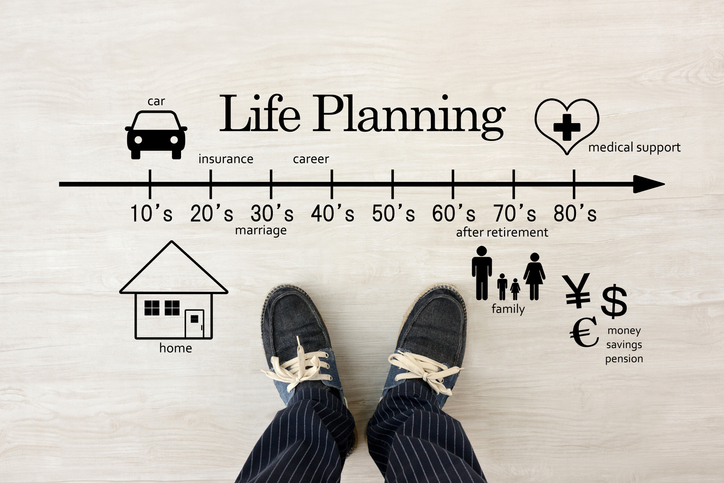

Going to college, having a baby, getting married, buying a house, retiring? Are you looking for help with making the best financial choices about major life events? Use the MyMoney.gov page to locate federal brochures, publications, websites and videos that can assist. The resources provide background information, helpful guidance, and hints and tips to assist with your decisions. As always, you can stop by any Crest Savings Bank location to discuss options.

Credit cards have become an everyday tool for people to make purchases and manage their personal finances. Access to credit enables families to purchase homes, deal with emergencies, obtain goods and services and build a credit history for larger purchases such as a car or home. Today, roughly 73 percent of all families have at least one credit card. About 60 percent of cardholders are “convenience users” – they avoid interest charges by paying balances in full each month. The ABA offers a list of credit card tips you should keep in mind.

It is never too early to periodically review your Social Security Statement through your personal my Social Security account. Your statement is an easy-to-read record of your earnings that determine your future benefits. With an interactive Retirement Calculator it allows you to run additional benefit estimate scenarios. It can compare how different future earnings and retirement benefit start dates affect your benefit amount.

Take advantage of free resources to increase your financial literacy. The Federal Deposit Insurance Corporation’s Money Smart financial education program and MyMoney.gov can help you enhance your financial skills. It has interactive games, podcasts, and game-based learning with separate tracks for all ages.

Week 2 – Youth and Money

The Consumer Financial Protection Bureau has developed a survey to help young people in grades 3-12 understand money skills, attitudes, and knowledge. The survey and guide for parents and caregivers can help you identify your child’s areas of strength and areas for growth. Start the survey now.

Preparing children for adulthood can be challenging. The Federal Deposit Insurance Corporation has developed the Money Smart for Young People curriculum. It offers parents and caregivers practical activities and conversation-starters on common financial topics.

The Consumer Financial Protection Bureau (CFPB) has developed over 250 learning activities. They cover every age group from preschoolers through high school students.

Get to know the building blocks children need on their journey to adult financial capability.

Research from the Consumer Financial Protection Bureau shows that the attitudes, skills, and habits adults need to make informed financial decisions and achieve financial peace of mind begin to develop in youth.

Explore four key steps on the journey to adult financial well-being, including a look at when, where, and how youth learn and develop the building blocks of financial capability.

Meet the Money Monsters

These Money Monster stories introduce children to ideas, habits, and activities that they’ll need as they grow up and start to manage money. Explore the Money Monsters story books.

Money as You Grow, developed by the Consumer Financial Protection Bureau, includes tools, tips, and activities for children of all ages designed to boost money skills and instill good financial habits.

Teens and young adults generally start to earn money and make decisions on their own. Adult supervision, guidance, and feedback can help them navigate successfully. Here are some resources from CFPB.

Week 3 – Older Adults & Financial Caregiving

Are you prepared?

If something happened and you had trouble paying your bills or managing your expenses, you’d need a trusted financial advocate to step in and help. Being in charge of your money tomorrow starts with planning today. Use this Road Map to get started.

The management of your or another person’s finances due to changing life circumstances such as aging, disability, or illness can be challenging. The ABA Foundation and CFBP has a variety of resources to guide you on the journey, whether you’re an older adult, a senior who needs a caregiver or a potential caregiver looking for ways to help.

Millions of Americans manage money or property for a loved one who’s unable to pay bills or make financial decisions. Knowing your options will help you choose what works best for your situation. Start with this guide from CFPB.

Consider formalizing your arrangement with your financial caregiver so your caregiver has the legal authority to make financial decisions on your behalf. A formal arrangement also mandates that your caregiver has a fiduciary responsibility, or an obligation to serve in your best interest. The ABA provides information to help you.

The key to spotting Elder Financial Abuse is to look for change in a person’s established financial patterns. Here is a handout with 14 Red Flags to look for from the ABA. In addition there is a link to the FDIC’s Money Smart for Older Adults Program which raises awareness among older adults and their caregivers on how to prevent fraud, scams, and other elder financial exploitation.

So many of us, whether we realize it or not, are caregivers. Family & friends provide unpaid care to older adults and adults with disabilities—the majority of whom also juggle a job or other responsibilities. Wearing all of these hats can take its toll. The National Council on Aging can help.

Financial caregivers play an important role in ensuring that their loved ones’ finances are managed wisely to maintain the best quality of life possible. The ABA provides some best practices for financial caregivers.

Week 4 – Prepare and Protect

FDIC deposit insurance enables consumers to confidently place their money at thousands of FDIC-insured banks across the country. It is backed by the full faith and credit of the United States government. Since the founding of the FDIC in 1933 no depositor has lost a penny of FDIC-insured funds.

Fraudsters have become increasingly adept at getting people to share the information they need to commit fraud by posing as financial institution call center agents, or by sending text messages that look like they are coming from their bank, warning of suspicious transaction activities. See Crest Savings Tips on how you can protect yourself.

It’s one thing to prepare your family, pets, and property for extreme weather situations. It’s another to protect your personal information and finances from scammers who use weather emergencies to cheat people. This CFPB has information to help you prepare for, deal with, and recover from a weather emergency.

Identity theft involves acquiring key pieces of someone’s identifying information, such as name, address, date of birth, social security number, etc., in order to impersonate them. This information enables the identity thief to commit numerous forms of fraud. NJ Dept of Banking resources can help.

Setting up a dedicated savings or emergency fund is one essential way to protect yourself, and it’s one of the first steps you can take to start saving. By putting money aside—even a small amount—for these unplanned expenses, you’re able to recover quicker and get back on track towards reaching your larger savings goals. The CFPB provides an essential guide to building an emergency fund.

Safeguard your finances & identity. The ABA provides tips, guides and detailed steps to protect your financial and personal data.

Financial Preparedness by Ready.gov. Americans at all income levels have experienced the challenges of rebuilding their lives after a disaster or other emergency. In these stressful times, having access to personal financial, insurance, medical and other records is crucial for starting the recovery process quickly and efficiently.

How Money Smart Are You?

As we round out this Financial Literacy Month, Let’s see what you learned. Try How Money Smart Are You?

A suite of 14 games and related resources about everyday financial topics. It’s based on FDIC’s award-winning Money Smart program. Stay tuned for Financial Fridays throughout the year.