Is a CD Ladder right for you?

A CD ladder is a smart way to split your savings into different CDs that take different amounts of time to mature. This has some great advantages over a long-term CD.

First, with a CD ladder, you can get to some of your money more often without having to pay extra fees. As each CD in the ladder finishes its time, you can decide if you want to use the money or put it back into a new CD. It’s like having options for your cash!

Also, a CD ladder helps you not worry too much about interest rates going up or down. By spreading your money across CDs with different maturity times, you keep some of your money safe from changes in interest rates. If rates drop, you still have money in a higher-rate CD. If rates go up, you can put your money in a new CD with a better rate.

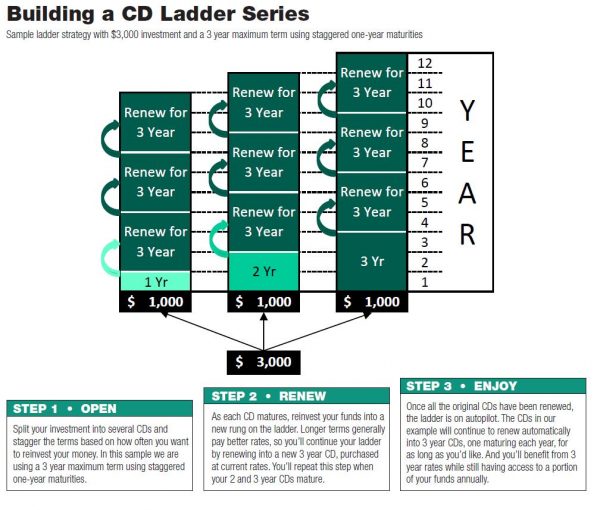

Starting a CD ladder is easy. The picture and steps below show how you can do it. Let’s say you have $3,000 to use. We’ll imagine you want to split it equally and that a 3-year CD works best for you. This way, every year, part of your money becomes available, giving you options to do different things with it. You are kind of expecting lower rates in the short term, but you’re okay with that because you get more flexibility if rates change a lot. After two years, your money will be in the CDs with the highest interest rates. About one third of your money becomes available each year, so you can decide what to do with it. And if you want, you can make your ladder even longer to grow your money more.

Keep track of your maturities: Although we will send you a maturity notice, stay on top of your CD ladder by setting up a reminder in your calendar that will pop up a few days before your CD is due. That way you’ll have plenty of time to decide if you want to take your money out or put it in another CD.

Crest Savings Bank offers CDs in a wide range of terms so you can build a CD ladder that best suits your needs.

- Your deposit is insured by the FDIC up to the limit allowed by law

Contact us now!

Call us at (609) 522-5115 or stop by one of our locations for more information.

*CDs typically come with early withdrawal penalties, which can wipe out any returns if you need to take the money out before the term is up. So, make sure the maturities you select work with your cash needs.